Introduction

Warren Buffett – Net Worth is a subject of great interest in the world of finance. He is not just one of the richest people in the world but also one of the most respected investors in history. This article will explore his incredible journey from a boy delivering newspapers to the leader of a massive company. We will look at how he built his fortune and the smart choices he made along the way. Understanding his story gives us lessons in patience, smart thinking, and investing for the long term.

Warren Buffett’s Early Life and Career Start

Warren Buffett was born in Omaha, Nebraska, in 1930. His interest in business started very young. At just 11 years old, he bought his first stocks. As a teenager, he ran several small businesses, like delivering newspapers and selling used golf balls. This early start taught him the value of hard work and saving money. He learned that investing is about owning pieces of good businesses, not just guessing which stock price will go up.

He studied investing at Columbia Business School under Benjamin Graham. Graham taught him the core idea of value investing. This means looking for companies that are selling for less than they are truly worth. Buffett used this lesson to build his career. He started his first investment partnership with friends and family. Through careful, smart choices, this small beginning grew into something huge.

How Berkshire Hathaway Built a Fortune

In the 1960s, Buffett began buying shares of a struggling textile company called Berkshire Hathaway. He saw potential where others did not. Over time, he changed Berkshire from a textile mill into a holding company. A holding company owns shares in other companies. Under Buffett’s leadership, Berkshire Hathaway started buying pieces of wonderful businesses.

“Price is what you pay. Value is what you get.” – Warren Buffett

This famous quote from Buffett explains his whole strategy. He focused on buying great companies at fair prices, not fair companies at great prices. Some of Berkshire’s most famous investments include:

-

The Coca-Cola Company: Berkshire bought a large stake in 1988. This investment has grown enormously over the decades.

-

American Express and Apple: Both are examples of brands with loyal customers, which Buffett loves.

-

Insurance Companies (like GEICO): These provide “float”—money collected as premiums that can be invested before claims are paid.

Berkshire also buys whole companies, such as BNSF Railway and Dairy Queen, to own them forever. This strategy of buying and holding for the long term is key to Buffett’s success. You can read about other successful business leaders in our list of the Top 10 Richest People in the World.

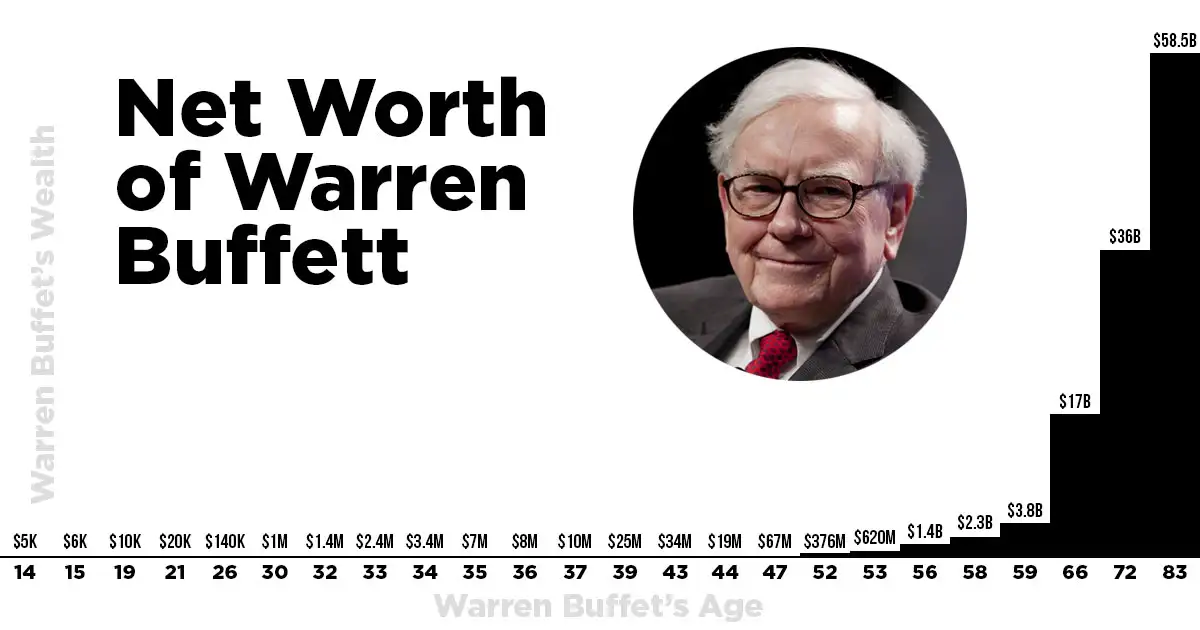

The Growth of Warren Buffett’s Net Worth

Warren Buffett – Net Worth has grown steadily because of his patient strategy. Unlike many billionaires whose wealth comes from founding a single tech company, Buffett’s fortune comes from decades of wise investing through Berkshire Hathaway.

For a very long time, he was among the top three richest people in the world. As of early 2026, his estimated net worth is approximately $149 billion, according to Forbes. This keeps him firmly in the top 10 of the world’s wealthiest individuals. It’s important to note that over 99% of his wealth is in Berkshire Hathaway stock. He doesn’t own fancy houses or yachts like other billionaires. He still lives in the same house in Omaha he bought in 1958.

His wealth also grows because Berkshire’s stock price increases. The company’s value reflects the combined worth of all the businesses it owns. When those businesses do well, Berkshire does well, and so does Buffett’s net worth. You can see real-time updates on billionaire wealth lists on sources like Forbes.

The Pillars of Buffett’s Investment Philosophy

Buffett’s success isn’t magic. It’s built on simple, powerful rules that anyone can understand.

-

Invest in What You Know: Buffett only invests in businesses he understands. He avoided the dot-com boom because he didn’t understand the technology, a move that saved him billions.

-

Look for a “Moats”: He likes companies with a strong competitive advantage, or a “moat.” This could be a powerful brand (like Coca-Cola), a unique technology, or low production costs. A moat protects a business from competitors.

-

Be Patient and Hold Forever: His favorite holding period is “forever.” He buys wonderful businesses with the intention of never selling them, letting their value compound over time.

-

Be Fearful When Others Are Greedy: He is famous for buying great companies during market crashes or bad news, when their prices are low. He sees downturns as sales.

Philanthropy: Giving Away the Fortune

Despite his massive wealth, Warren Buffett is famous for his plan to give it all away. He lives a modest life and believes that vast fortunes should be used to help society.

In 2006, he announced he would gradually give away 99% of his wealth to charity. Most of it goes to the Bill & Melinda Gates Foundation to improve global health and education. He also co-founded The Giving Pledge with Bill Gates and Melinda French Gates. This is a promise by the world’s richest people to give more than half of their money to charitable causes during their lifetime or in their will.

This act of giving back is a core part of his legacy. It shows that his goal was never just to collect wealth, but to use it as a tool to make a real difference. For a detailed look at his life and philanthropic plans, his Wikipedia biography is an excellent resource.

Conclusion: The Legacy Beyond the Net Worth

In summary, Warren Buffett – Net Worth tells the story of more than just money. It is a story of discipline, rationality, and incredible patience. He proved that you don’t need to invent the next big thing to build wealth; you need to make smart, logical decisions over a very long time. His journey from a curious boy in Omaha to one of the most successful investors ever inspires millions. His greatest legacy may ultimately be the billions he is giving away to solve the world’s biggest problems.

His story makes us wonder: In a world of quick trades and instant gratification, what can we achieve by applying just a little bit of Buffett’s long-term patience to our own goals?

References:

-

Biz Reporterz. (2026). Top 10 Richest People in the World – Success Stories & Biographies.

-

Forbes. (2026). Real-Time Billionaires List.

-

Wikipedia. (2026). Warren Buffett.