Introduction

In a world dominated by digital payments, knowing how to write a check remains a useful skill. Whether you’re paying rent, settling a bill, or sending a gift, checks provide a secure, traceable way to transfer money. This guide breaks down the process into easy steps, drawing from trusted banking practices to ensure you do it right every time. We’ll cover everything from basic setup to advanced tips, helping you avoid common pitfalls and stay confident.

Checks have been around for centuries, but their role in modern finance is still relevant. According to recent data, while check usage has declined—dropping from a peak of over 50 billion in the mid-1990s to about 18 billion in recent years—they account for around 5% of retail transactions in the US. That’s billions in value, especially for larger payments like rent or taxes where records matter. If you’re new to this or just need a refresher, stick around. We’ll make it straightforward and reassuring.

The History and Evolution of Checks

Checks trace their roots back to ancient times, but modern usage exploded in the US after the Federal Reserve Act of 1913. Before that, payments were slow and costly, often involving circuitous routing through friendly banks. By the 1920s, checks became a staple for middle-class households, peaking post-World War II as prosperity grew.

Statistics show a fascinating trend: In 1929, the Fed handled about 900 million checks annually. This doubled every decade, hitting 16 billion by 1980. Volumes crested in the early 1990s before digital alternatives took over. Today, millennials surprisingly lead in check use—42% write them regularly, often for business or large transactions. Why? Checks offer physical proof, which is vital for legal or tax purposes.

Despite the drop—check-writing fell 75% since 2000—they persist in sectors like construction, real estate, and government. Understanding this background helps appreciate why mastering how to write a check is still empowering in 2026.

Why Use Checks in a Digital Age?

You might wonder: With apps and cards everywhere, why bother? Checks shine in scenarios needing a paper trail. For instance, landlords often prefer them for rent, as they create verifiable records. Banks like Armed Forces Bank note that military families favor checks for budgeting during deployments.

Recent surveys reveal 15% of adults write a few checks monthly, mainly for bills or gifts. They’re free (unlike some wire transfers), and no tech glitches interrupt them. Plus, in fraud-prone times—check fraud hit $24 billion in 2024—they’re safer when handled right. If digital payments fail you, checks step in reliably.

What You Need Before Starting

Gather these essentials to make the process smooth:

- Checkbook: Issued by your bank, containing blank checks and a register for tracking.

- Pen with blue or black ink: Avoid pencils or colored pens—they’re erasable and may not scan.

- Recipient details: Full legal name, amount, and purpose.

- Sufficient funds: Check your balance to prevent overdrafts, which can incur fees.

If you lack checks, order them via your bank’s app or branch. Many offer free reorders for account holders.

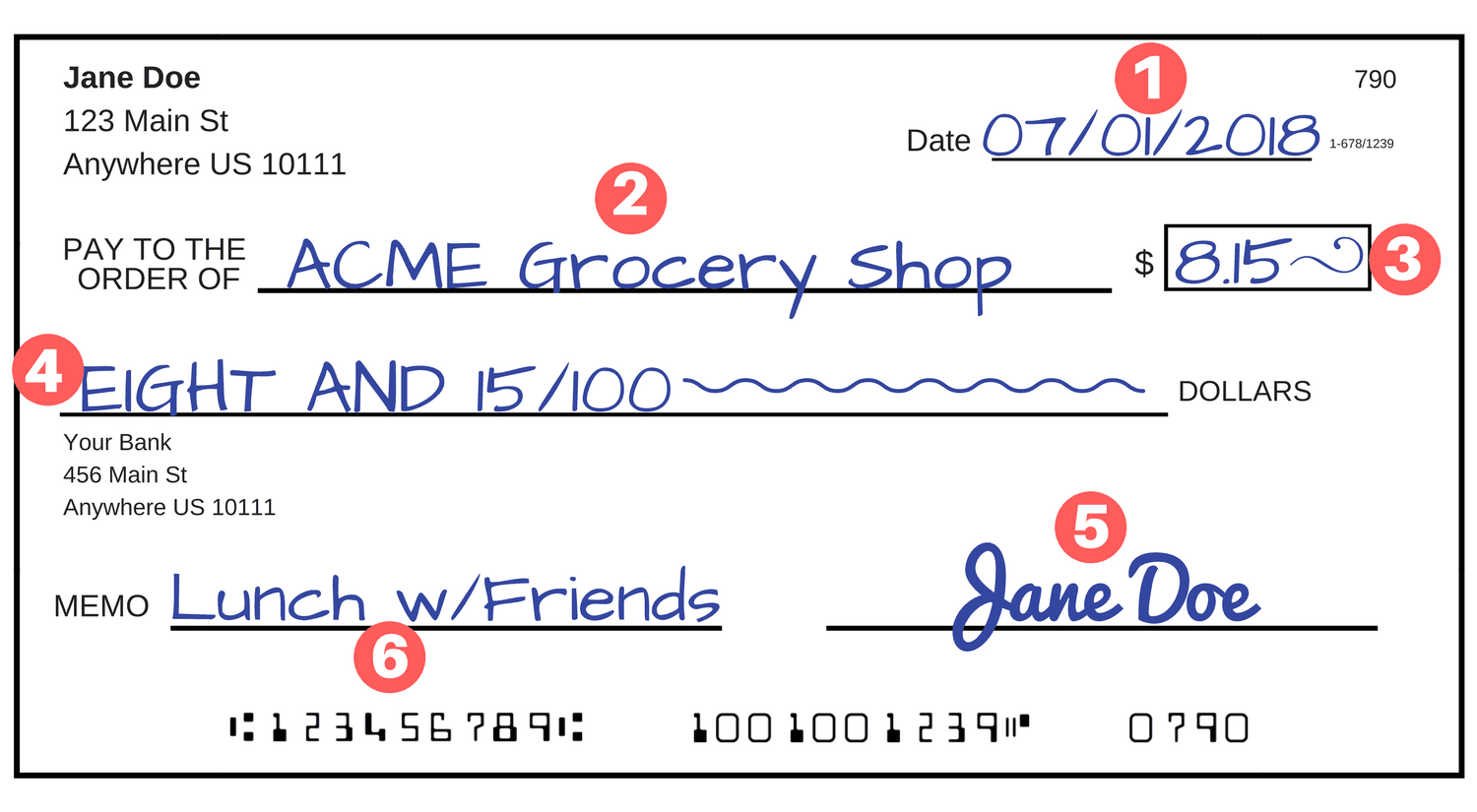

Step-by-Step Guide: How to Write a Check

Filling out a check takes six key steps. Follow them actively to ensure accuracy.

- Date the check. In the top-right corner, write the current date in MM/DD/YYYY format. Use today’s date—post-dating (future dates) isn’t guaranteed and could cause issues.

- Name the payee. On the “Pay to the Order Of” line, enter the recipient’s full name or company. Spell it correctly; banks may reject mismatches. Avoid “cash” unless you want anyone to deposit it.

- Enter the amount in numbers. In the box with the dollar sign, write the exact amount, like $1,250.00. Include cents for precision.

- Write the amount in words. Below the payee line, spell it out, e.g., “One thousand two hundred fifty and 00/100.” Draw a line to the end to prevent alterations.

- Add a memo (optional). Note the purpose, like “January Rent” or “Gift.” This helps with records.

- Sign the check. In the bottom-right, use your registered signature. Without it, the check is invalid.

Double-check everything before handing it over. Record the transaction in your check register to track spending.

Examples of Filled-Out Checks

Let’s apply this to real scenarios.

For Rent: Payee: Your landlord’s name from the lease. Amount: $1,250.00 (numeric); “One thousand two hundred fifty and 00/100” (words). Memo: “February 2026 Rent, Apt 5B.”

For a Bill: Payee: Utility company. Amount: $85.67; “Eighty-five and 67/100.” Memo: “Account #123456.”

With Cents: For $130.45, write “One hundred thirty and 45/100.” This prevents confusion.

Round Amount: $500.00 becomes “Five hundred and 00/100.”

These examples show how to write a check adapts to needs, keeping things clear.

Common Mistakes and How to Avoid Them

Even experts slip up. Here are pitfalls to sidestep:

- Mismatching amounts: Numeric and words must align. Solution: Write words first, then match numbers.

- Wrong ink or pencil: Use blue/black pen only. Pencil erases easily, risking fraud.

- Post-dating: Banks might cash early. Use current dates.

- Inconsistent signatures: Match your bank’s record. Practice if needed.

- Leaving spaces: Fill lines fully to block tampering.

- Overdrawing: Check balance beforehand.

- Misspelling payee: Verify from official docs.

If you err, void the check by writing “VOID” across it and start fresh. Don’t alter—banks reject changes.

For more on rent-specific errors, check this guide from Armed Forces Bank.

Tips for Safe and Effective Check Writing

Stay secure with these expert pointers:

- Use fraud-prevention features: Opt for checks with watermarks or holograms.

- Log every check: Update your register immediately to avoid surprises.

- Deliver wisely: Hand-deliver or use certified mail for valuables.

- Verify funds: Apps make this quick—ensure coverage.

- Order checks securely: Through your bank, not third parties.

- Monitor statements: Spot unauthorized activity fast.

In 2024, check washing scams cost $815 million. Write in permanent ink and fill all spaces to protect yourself.

For general banking basics, see this resource from Huntington Bank.

Alternatives to Writing Checks

If checks feel outdated, consider these options:

- Debit/credit cards: Instant, with rewards on credit.

- ACH transfers: For bills or payroll—free and automated.

- P2P apps: Like Venmo or Zelle for quick person-to-person.

- Wire transfers: For large, urgent sums.

- Money orders: Prepaid and secure, like checks but without a bank account.

These cut fraud risks and speed things up. Still, checks work when digital fails.

FAQs About How to Write a Check

What if I make a mistake? Void it and rewrite. Don’t cross out.

How to write a check with cents? Include them in both formats, e.g., $50.75 and “Fifty and 75/100.”

Can I write a check to two people? Yes, use “and” (both endorse) or “or” (either can).

Do checks expire? Personal ones after 6 months; business vary.

How to void a check? Write “VOID” large across the front.

For more step-by-step insights, explore guides like this one on screen recording, which shares similar clear instructions.

Conclusion

Mastering how to write a check is simple once you follow the steps: date it, name the payee, add amounts in numbers and words, memo if needed, and sign. With tips to dodge mistakes and boost safety, you’ll handle payments confidently. Though usage dips, checks offer reliability in key situations like rent or gifts. Remember, accuracy prevents issues—double-check always.

What was your last check for, and how did this guide help? Share in the comments!

References

- Armed Forces Bank: Guide on writing checks for rent. Targets military families and renters seeking reliable records.

- Huntington Bank: Basics of check writing. Aimed at beginners and infrequent users needing fraud tips.

- Biz Reporterz: Step-by-step tech guides. Useful for audiences learning structured processes.

For more finance and tech advice, visit Biz Reporterz.