Binance Founder Zhao Denies Crypto Market Crash Accusations – this phrase captures the heart of a recent storm in the crypto world. Changpeng “CZ” Zhao, the founder and former CEO of Binance, stepped up to clear the air. He called claims that his exchange caused a massive market drop “far-fetched.” This comes after an October 2025 event that wiped out $19 billion in positions. Traders faced glitches and odd prices on the platform. Zhao spoke out in a live session on Binance’s social site. He stressed that Binance paid out $600 million to help affected users. But he insists the exchange did not start the crash.

Many wonder what led to this mess. The crypto market can swing wildly. Leverage lets traders bet big with little cash. When prices drop fast, systems force sales to cover losses. This creates a chain reaction. In October, a glitch in Binance’s system mismatched prices. Stablecoins like USDe lost their peg briefly. This sparked panic and more sales. Yet Zhao points to bigger forces at play, like market mood and outside events.

Who Is Changpeng Zhao? A Quick Background

Changpeng Zhao, or CZ, built Binance into the top crypto exchange. Born in China, he moved to Canada as a teen. He studied computer science and worked in finance tech. In 2017, he launched Binance during the crypto boom. It grew fast thanks to low fees and many coins. By 2021, it handled billions in trades daily.

CZ’s career shines with wins. He made Binance a hub for new tokens. He pushed for better rules in crypto. But troubles came too. In 2023, U.S. regulators hit him with charges. He stepped down as CEO and paid fines. Now, he advises from Abu Dhabi, where Binance has a base. His net worth sits around $30 billion, per estimates.

Despite setbacks, CZ stays key in crypto. He tweets often about trends. His denial of crash blame shows his fight to protect Binance’s name. For traders, knowing his story helps trust his words.

The October 2025 Crypto Market Crash: What Happened?

The crash hit on October 10, 2025. Prices fell sharp in minutes. Bitcoin dropped 15% fast. Ethereum followed suit. Total liquidations reached $19 billion – a record. This beat past events like the 2022 FTX fall.

Why did it happen? Several factors mixed:

- High leverage: Traders used 100x bets. Small drops wiped them out.

- Technical issues: Binance users saw wrong prices. This triggered auto-sales.

- Market sentiment: News of tariffs and rate hikes scared investors.

- Chain reaction: One sale led to more, like a domino fall.

Binance admitted glitches but fixed them quick. They compensated $600 million. This helped some, but not all. Critics say the exchange’s size made the problem worse. As the biggest platform, its issues ripple far.

Compare this to other crashes. In 2021, Bitcoin flashed down due to power outs in China. In 2018, a bear market lasted months. The 2025 event was short but deep. It showed risks in centralized exchanges.

Stats tell the tale. Crypto market cap lost $300 billion that day. Open interest – bets on futures – dropped 20%. Ethereum saw $1.15 billion in liquidations alone, per data from CoinGlass. This hurt retail traders most. Many lost savings in seconds.

Binance Founder Zhao Denies Crypto Market Crash Accusations: His Side of the Story

Binance Founder Zhao Denies Crypto Market Crash Accusations in a clear way. During the AMA, he said, “There are a larger group who claim the October 10th crash was caused by Binance and wants Binance to compensate everything.” He rejected this outright. Zhao noted regulators watch Binance closely. In Abu Dhabi, officials see all trades. This means no hidden tricks.

He blamed external factors. Tariff news from the U.S. sparked fear. Leverage built up too high. The glitch was minor, he claims. Binance handled it and paid up. This shows responsibility, not guilt.

Experts agree partly. A Bloomberg report says the crash stemmed from systemic risks, not one exchange. CoinDesk notes liquidations happen in volatile times. Yet some users sue for more compensation. They argue Binance should prevent such errors.

For context, look at similar cases. FTX’s Sam Bankman-Fried faced jail for fraud. CZ’s case was lighter – money laundering charges, but no intent to harm. His denial fits a pattern of defending the platform.

Impacts on the Crypto Market

The crash shook trust. Many moved to decentralized exchanges like Uniswap. DeFi TVL rose 10% post-event. Centralized spots like Binance saw volume dip 5%.

Broader effects:

- Regulation push: Governments eye stricter rules on leverage.

- Investor caution: Fewer use high-risk bets now.

- Price recovery: Bitcoin bounced back to $95,000 by January 2026, then corrected.

- Stablecoin stress: USDT held steady, but others wobbled.

Tether’s profits dropped 23% in 2025 amid fundraising. This links to market volatility. Ethereum trends show drops to $2,300 in early 2026. Bitcoin plunged below key levels too.

For traders, this means diversify. Use multiple exchanges. Set stop-losses. Avoid max leverage.

How Binance Responded

Binance acted fast. They fixed the glitch in hours. Then, they reviewed systems. New updates cut mismatch risks. Compensation went to affected accounts.

CZ’s words reassure. He said, “If you are living in those world in your head, you are unlikely to be successful in the future.” This urges focus on facts.

The exchange boosts transparency. They publish reserves monthly. This builds trust.

Lessons for Crypto Investors

Learn from this:

- Risk management: Limit leverage to 5x or less.

- Diversify platforms: Trade on Binance, Coinbase, and DEXs.

- Stay informed: Follow news on crypto news sites.

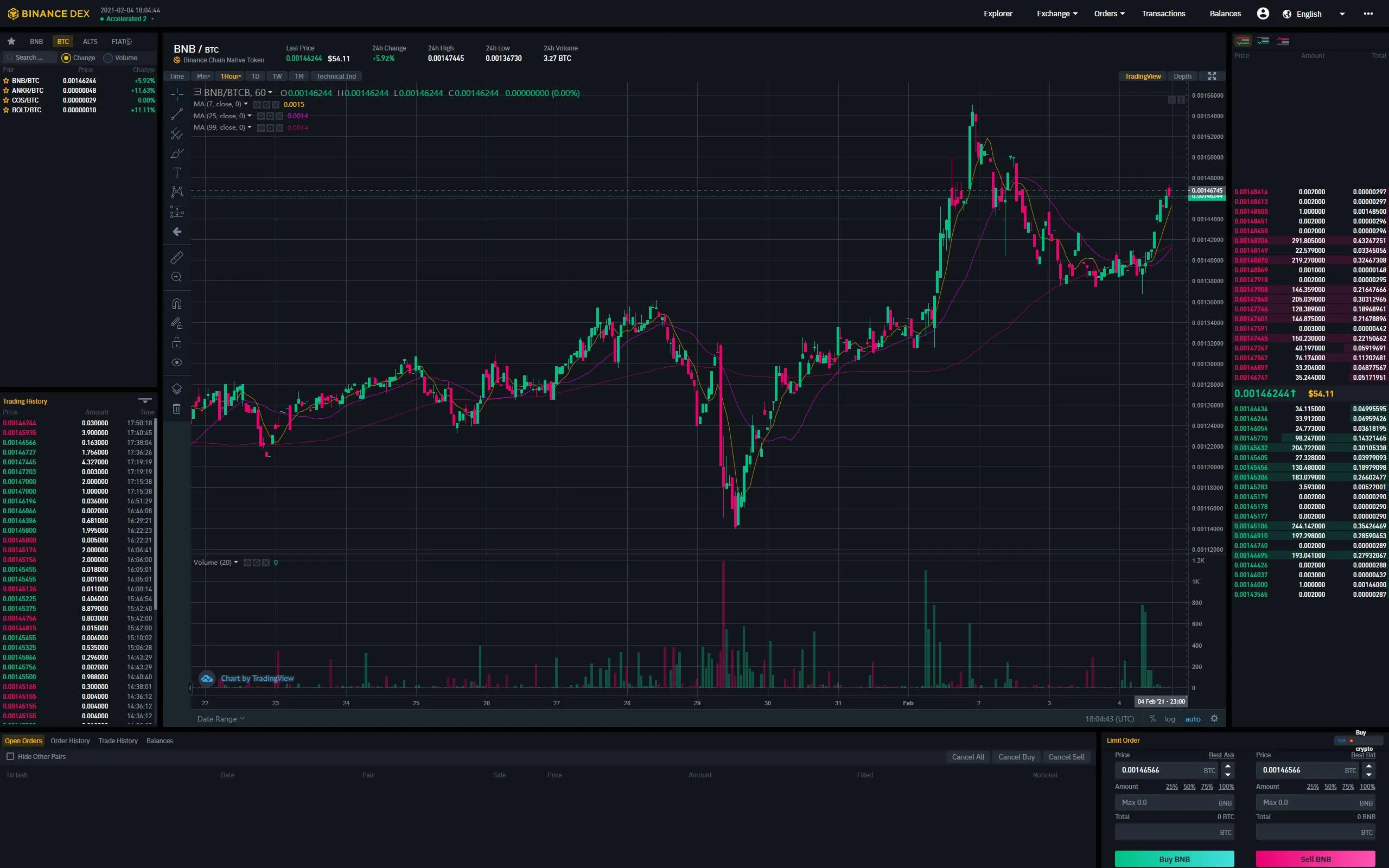

- Use tools: Charts from TradingView spot trends.

Stats show 70% of liquidations hit longs. Short sellers won big. In volatile times, hedge positions.

Future Outlook for Binance and Crypto

Binance stays strong. Volumes recover. New features like AI trading help. CZ’s role as advisor keeps influence.

Crypto market rebounds often. After 2022 lows, it hit highs in 2024. 2026 could see $100,000 Bitcoin if regs clear.

Watch ETF flows. Outflows hurt prices, as in Ethereum’s case. Inflows signal bulls.

FAQs

What caused the October 2025 crash?

A mix of leverage, glitches, and news sparked $19 billion liquidations.

Did Binance cause it?

Binance Founder Zhao Denies Crypto Market Crash Accusations, blaming broader factors.

How much did Binance pay?

$600 million in compensation.

Is crypto safe now?

Yes, with smart risks. Markets mature.

What’s next for CZ?

He advises Binance and speaks on trends.

Conclusion

Binance Founder Zhao Denies Crypto Market Crash Accusations, highlighting facts over blame. The October event taught hard lessons on risks. Yet crypto endures. Traders who adapt thrive. Binance compensated and improved. Market cap grows despite dips. In summary, Zhao’s stand reassures amid volatility. Focus on long-term growth. What do you think – was Binance at fault, or just part of a bigger picture?

References

- Bloomberg: Binance Founder Zhao Fends Off Crypto Market Crash Accusations

- Yahoo Finance: Binance co-founder CZ dismisses blame for October crypto crash

- Bitcoin Plunges Below $80,000 as the Crypto Slide Deepens

- Ethereum Market Trends

- Tether’s Annual Profit Drops 23% In Midst of Fundraising

This article targets crypto investors aged 25-50, interested in market stability, exchange reliability, and trends like liquidations and ETF flows. It uses secondary keywords like crypto liquidation event, technical glitches; LSI terms like market volatility, leveraged positions; long-tail keywords like Changpeng Zhao denies Binance role in crypto crash.